A cap table service is an online service that manages records of shareholdings in a company. Furthermore, these services often provide value adding features, like investor communications, agreement signing and share transfer services.

In this post, we take a look couple of well-known services and if they can be used for an international company. In this case, an international company means a company outside the US, having its shares nominated in some other currency that is not the United States Dollar (USD). Many of the services in this space focus on the US markets, so it is somewhat hard to find one for managing international or EU cap table. I did a quick onboarding test and also tweeted for the service providers for additional help.

This post focuses on onboarding and getting started with a cap table service. My criteria includes:

- Offers self sign up, so that you can start using a service without a compulsory call with a sales representative

- Transparent, upfront, pricing

- Knows about world currencies (Euro, Pound, others)

Table of contents

Carta #

Carta is one of the most well-known cap table management brands with a unicorn level $1.7B valuation.

Unfortunately their "Plans & Pricing" is short of pricing, so it does not fill the criteria of transparent pricing. They, however, offer a free tier up to 25 shareholders "Talk to your lawyer". My gut feeling is that they want to ensure there is a legal involved and Carta wants to avoid possible association with a mess if people go and do their own securities issuances without a lawyer. It also sounds a good tactic to sell more Carta services through affiliate lawyers.

In other news, Carta acquired Kik blockchain team, so one could assume they are also coming out with tokenised shares in the future.

2/ https://t.co/INs2EaFFuZ - @cartainchttps://t.co/INs2EaFFuZ is one of the most well-known brands with unicorn valuation in billions.

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: No public pricing - not going to call you to get the price pic.twitter.com/rvtxAPGc8e

Captable.io #

Captable.io comes with a good domain name that does not leave room to guess what their service does. They are affiliated with Long-Term Stock Exchange, Silicon Valley's secondary market for IPOs.

However, at the writing of this, it seems like Captable.io has only US dollars are there. Thou Ray Shan from LTSE later reached out and explained this limitation concerns only the onboarding wizard.

3/ https://t.co/8i90Cg2H8Y - @ltse

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: Supports only US Dollar nominated shares pic.twitter.com/yo5o11ZBAE

Gust #

Gust presents itself as a startup planner. They do not offer just a cap table management, but a full package to get your US startup business started, with Delaware incorporation. Gust is a full-fledged online fiduciary.

However, you cannot decouple these services. One would need to buy in the full package with its corporate governance and it is not an option unless you want to get a Delaware shop.

4/ https://t.co/b3yn0IyS7J - @gustly

— Mikko Ohtamaa (@moo9000) January 7, 2020

More focused on "company-as-a-service" and investor discovery.

Dealbreaker: A neat concept, but for pre-seed companies it is offering "too much at once". pic.twitter.com/Zk5gg95CgU

ShareWorks #

ShareWorks is backed by no one else but the famous investment bank Morgan-Stanley. ShareWorks touts itself as "Equity Management Solutions" and they offer startup packages.

However ShareWork pricing is not public. Might well call the page "Talk to sales" instead of "Pricing" if you fail to display any actual prices.

5/ https://t.co/vTnqOZ3vDq by Morgan-Stanley - @morganstanley

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: No self-service in. Not interested requesting a demo, when other services are offering direct self-service onboarding.

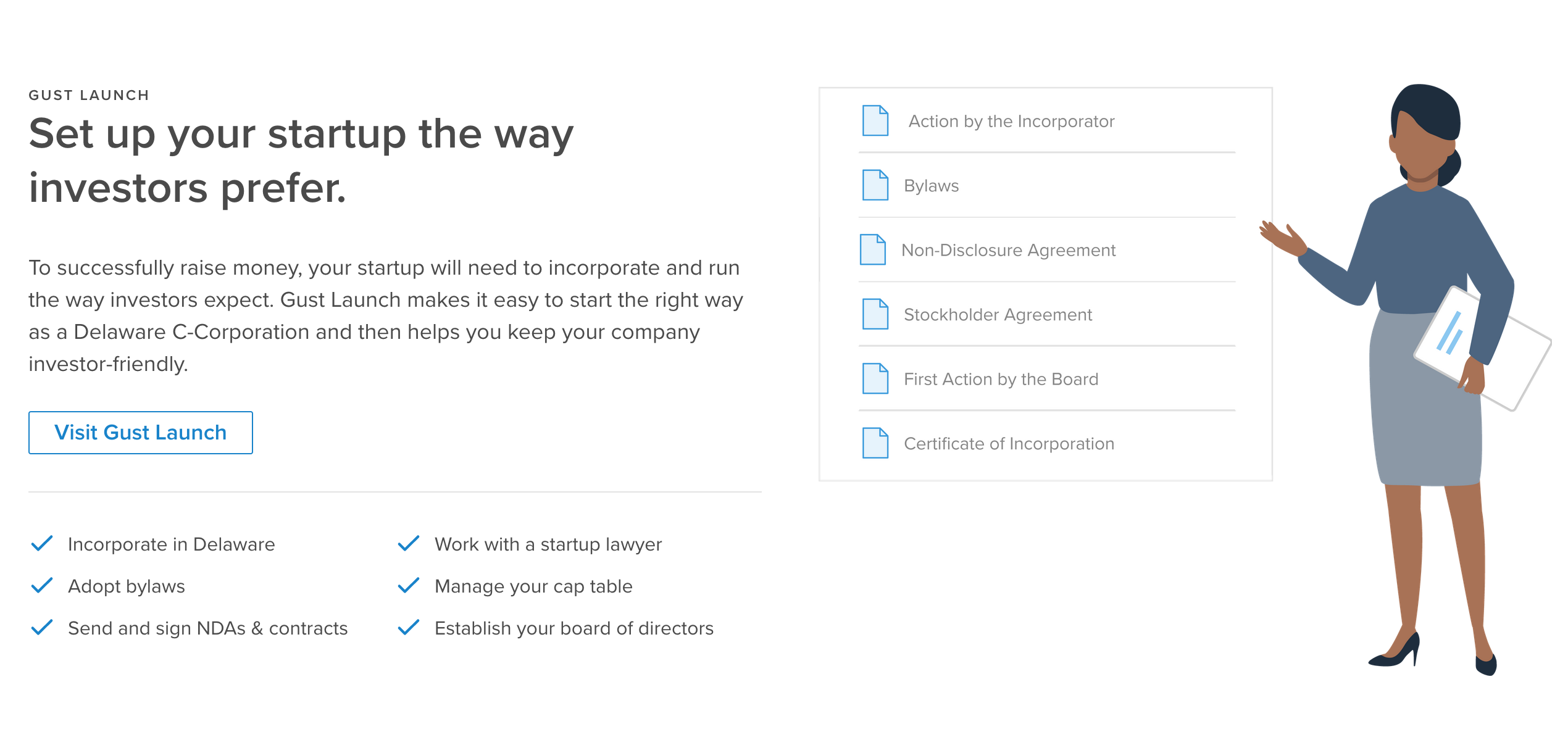

EqVista #

EqVista is a very promising candidate for a cap table management. On this list, they are the first that trusts their platform quality so much that they offer a freemium starter package.

EqVista pricing is $2 per shareholders - though they forget to mention if it is monthly or yearly. Works for traditional companies, but a crowdfunded company with hundreds or thousands of shareholders might want to negotiate a fixed price deal.

However, looks like the deal breaker here is the lack of support for international currencies.

6/ https://t.co/T5RHXZJdM1 - @eqvista

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: Supports only US Dollar nominated shares pic.twitter.com/SLXTsvkSpV

Vestd #

Vestd is the UK only cap table management solution. The UK as a jurisdiction is a bit different, because you need to report full shareholder information to Companies House. As opposed to most of the other jurisdictions that let companies manage their own shareholder registries. Their specialisation is employee share schemes, or options.

Vestd is a good solution if you are looking to incorporate in the UK. The UK offers EMI (Enterprise Management Incentive) tax schemes for startups making it very tax-efficient to have employee options or crowdfunded equity there.

7/ https://t.co/9KtWMq2Mrv - @VestdHQ

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: Supports only UK companies, as they are integrated with Companies House pic.twitter.com/BvjdMdcJTc

CapDesk #

CapDesk is Number One equity management solution in the UK and Europe, according to their own words. They offer competitive pricing for small enterprises.

However, a mandatory sales representative call is needed. No self sign up to explore the platform.

8 /Capdesk.com - @capdesk

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: No self-service. Not interested in requesting a demo.

Also, their chatbot is horrible - I just wanted to type in my enquiry and get an answer, instead of going through useless questions pic.twitter.com/16S4iJfuTM

KoreConX #

KoreConX is a cap table management solution with a slogan "free forever" - making it music to the ears of any CFO.

They also offer international trade transfer services, deal room and investor relation management - a good round package overall. Personally, I also have a soft spot for them as they are building a share registry on HyperLedger blockchain.

Though, I had some bad problems in their self sign-up process - I could not finish it and get in the system, despite reporting the issues to the support. These seemed to be technical issues and bugs, so I hope they have managed to fix them over time.

9/ https://t.co/cn6JvwjVgT - @KoreConX

— Mikko Ohtamaa (@moo9000) January 7, 2020

Dealbreaker: I was not able to complete onboarding, as I could not answer my own security questions which set up a second ago. Reset by SMS did not work. pic.twitter.com/aYw0f0jhn8

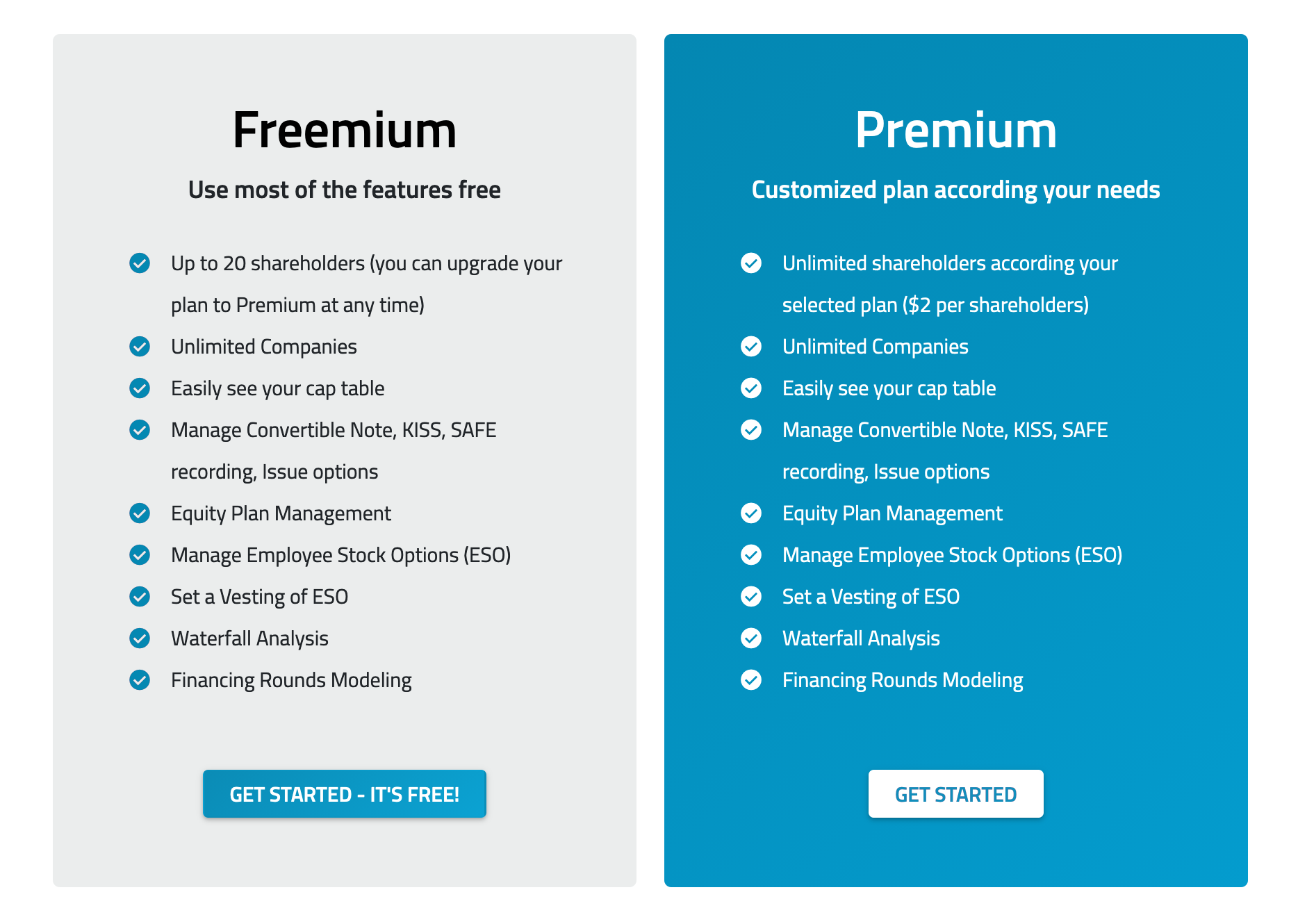

EquityEffect #

EquityEffect made me happy. They offer a self sign-up, though takes some effort to find it.

If you’re a private company with less than 50 equity owners, fill out the form below to start using EquityEffect for free. You’ll be directed to the EquityEffect app.

The pricing page is "we’ll point you in the right direction", but at least they make it sound like it will be very competitive.

You can manage different kind of securities: equity, options and warrants. You have a scenario tool that allows to model different future rounds. There are utilities for a stock split, cap table backup. There is a function to create share certificates, though as far as I know, most jurisdictions do not need individually numbered certificates anymore and managing databased based cap table is enough. Besides catering to both investors and private companies, EquityEffect offers a white-label service for law firms.

At, as the cherry on the top, the pricing settings offer multiple currencies.

10/ https://t.co/EdIk1enmQS - @EquityEffect - WE HAVE THE WINNER 🏆🏆🏆

— Mikko Ohtamaa (@moo9000) January 7, 2020

I signed up, went in and created company shares. Not only they support multiple currencies, but they allow multiple currencies per company and cap table. pic.twitter.com/nV1OAfANoz

Shoobx #

Somebody was watching Twitter. Shoobx reached out to me and asked to check their offer.

Shoobx is the only all-in-one solution for your company’s HR, equity, fundraising, and governance needs from incorporation to exit.

Shoobx aims for higher value added "the legal automation tool for your startup" category. Besides cap table services, they offer recruiting and payroll tools - no need to get separate systems for them. They also target seed level companies to raise easily with SAFE notes, with an integrated data room.

I could not self sign up, so I do not know whether there are settings for non-dollar and non-US companies.

You should check out https://t.co/2EpHwcjhZ6! We'd be happy to schedule a demo to see if it fits your needs.

— Shoobx, Inc. (@ShoobxInc) January 8, 2020

Conclusion #

It is the US centric world where the capital lives. It makes sense, as the US is still the country go for companies to grow and Delaware is the state where your stamp duties will be paid. On the other hand, it seems there is still no "Über of company legal services" platform which would have any significant global foothold.

Comments

Send any feedback and comments by replying the Twitter thread.

Discuss