This blog post is based on the guest presentation at the Blockchain in Digital Business course at University of Jyvaskyla, later also made available as a Twitter thread.

1/ The evolution and future of cryptocurrencies... or how we ended up with where are today with #Bitcoin, #DeFi and blockchains.

1/ The evolution and future of cryptocurrencies... or how we ended up with where are today with #Bitcoin, #DeFi and blockchains.A (long) thread.

👇👇👇

Hold tight, I'll be your ride operator.

3/ The material presented here is originally from my guest presentation given on @uniofjyvaskyla course "Blockchain in Digital Business."

As far as I know, it is the first interdisciplinary course on blockchains in Finland, and likely one of the firsts in Nordics.

As far as I know, it is the first interdisciplinary course on blockchains in Finland, and likely one of the firsts in Nordics.

4/ I examine the cryptocurrency years 1990 to 2020.

When we explore the topic of cryptocurrencies we can look at them from few different perspectives.

When we explore the topic of cryptocurrencies we can look at them from few different perspectives.

5/ One perspective is technical: how blockchains, technologies underpinning cryptocurrencies, are programmed in past, now and in the future.

5/ One perspective is technical: how blockchains, technologies underpinning cryptocurrencies, are programmed in past, now and in the future.This is mostly related to computer science, cryptography and math theory.

6/ What kind of performance characteristics blockchains have? What kind of trade-offs are made?

What makes one blockchain better over another?

What makes one blockchain better over another?

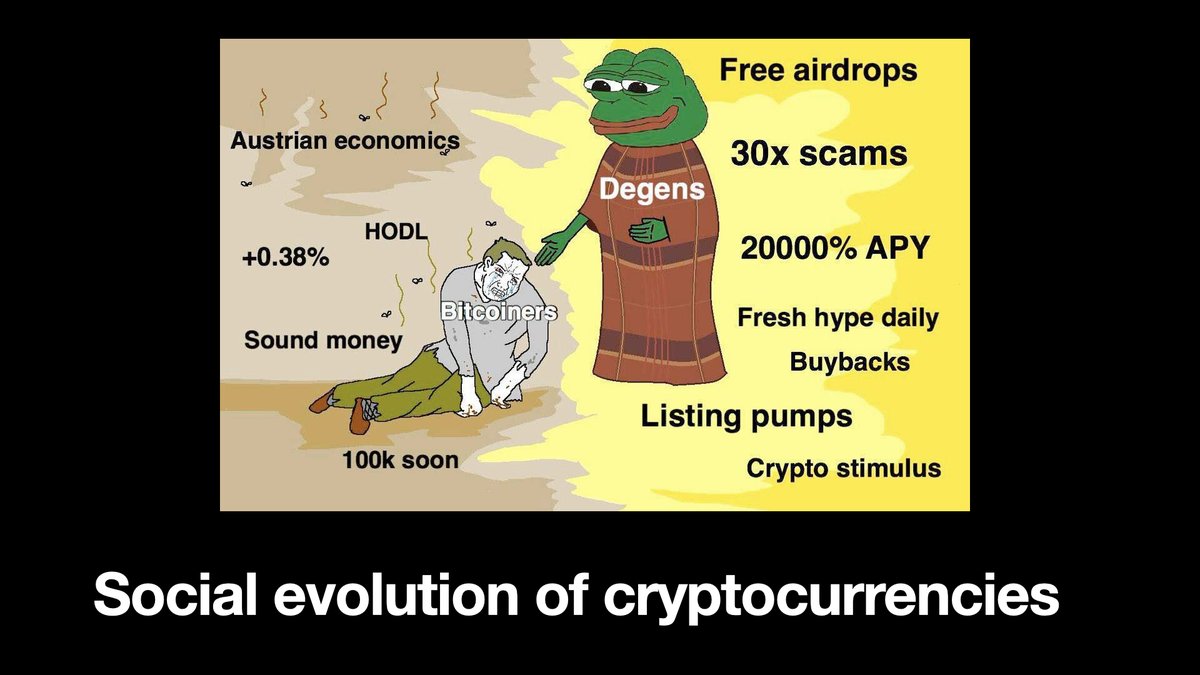

7/n Then we have social and cultural perspective: the evolution from a cyberpunk and anarchy movement to the most popular bet on Wall Street.

How did Bitcoin evolve to separate coins, each one of them having a cult following?

How did Bitcoin evolve to separate coins, each one of them having a cult following?

8/ What kind of communities there exist and how did they form? What was the driver of the ICO boom? Is crypto nothing but investment scams?

This perspective mainly discussed the evolution of crypto communities and the purpose of the movement.

This perspective mainly discussed the evolution of crypto communities and the purpose of the movement.

9/ Then we the macroeconomic perspective: how do cryptocurrencies change the world?

This relates to fiscal and monetary policy and is especially topical now during the time of pandemic when governments are getting massively in debt.

This relates to fiscal and monetary policy and is especially topical now during the time of pandemic when governments are getting massively in debt.

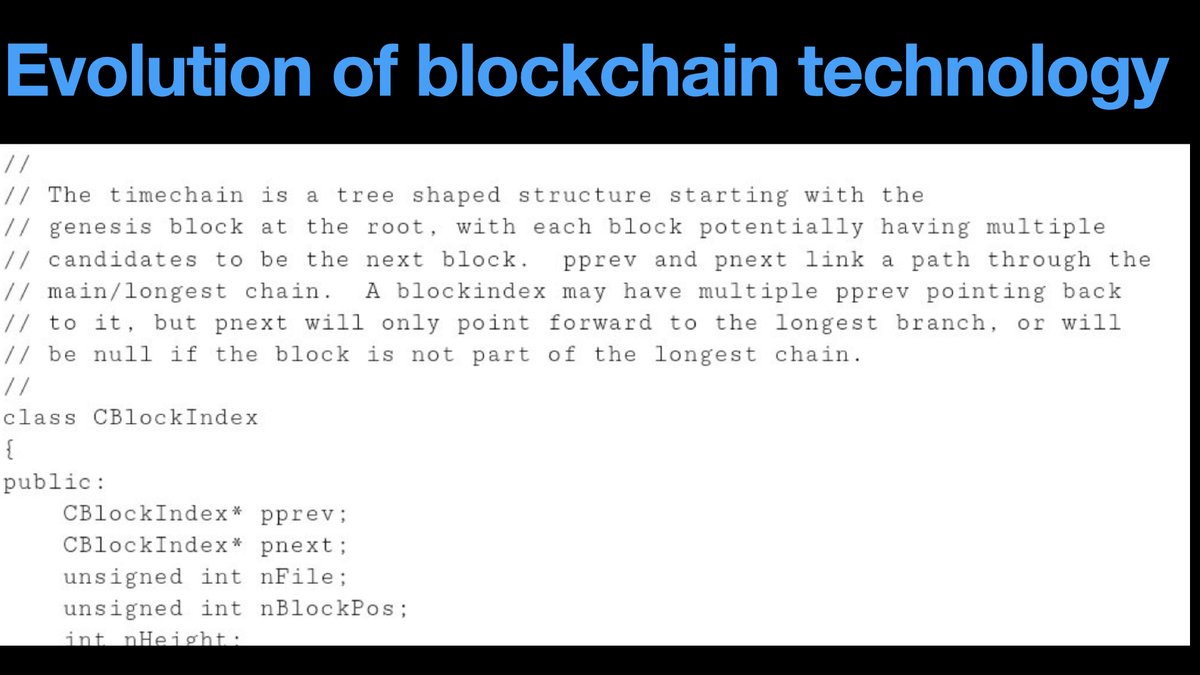

11/ First we look at the technological perspective: elements, architecture and programming of the blockchains.

11/ First we look at the technological perspective: elements, architecture and programming of the blockchains.The change in technology is fundamental to understand the cultural elements later.

👇👇👇

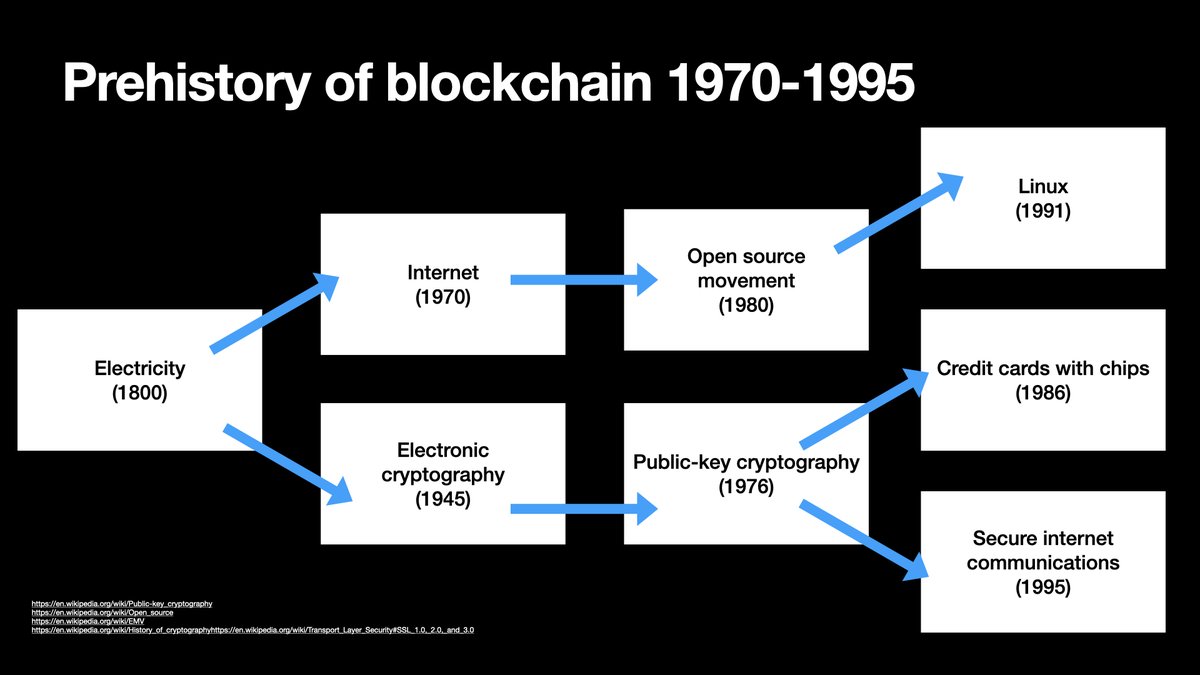

12/ We start by looking at the prehistory of blockchain. We need to understand what we had to invent before we could invent blockchain and why.

13/ The most important is establishing the internet. We did not have "good enough cables" until 00s.

13/ The most important is establishing the internet. We did not have "good enough cables" until 00s.

14/ The other key element is public-key cryptography. It does not back up all blockchain transactions, but also your chip credit card transactions and secures all Internet communication.

16/ There was an early failed attempt called Digicash in the 1990s. In Digicash, each coin is what we nowadays call "NFT".

taler.net/en/index.html

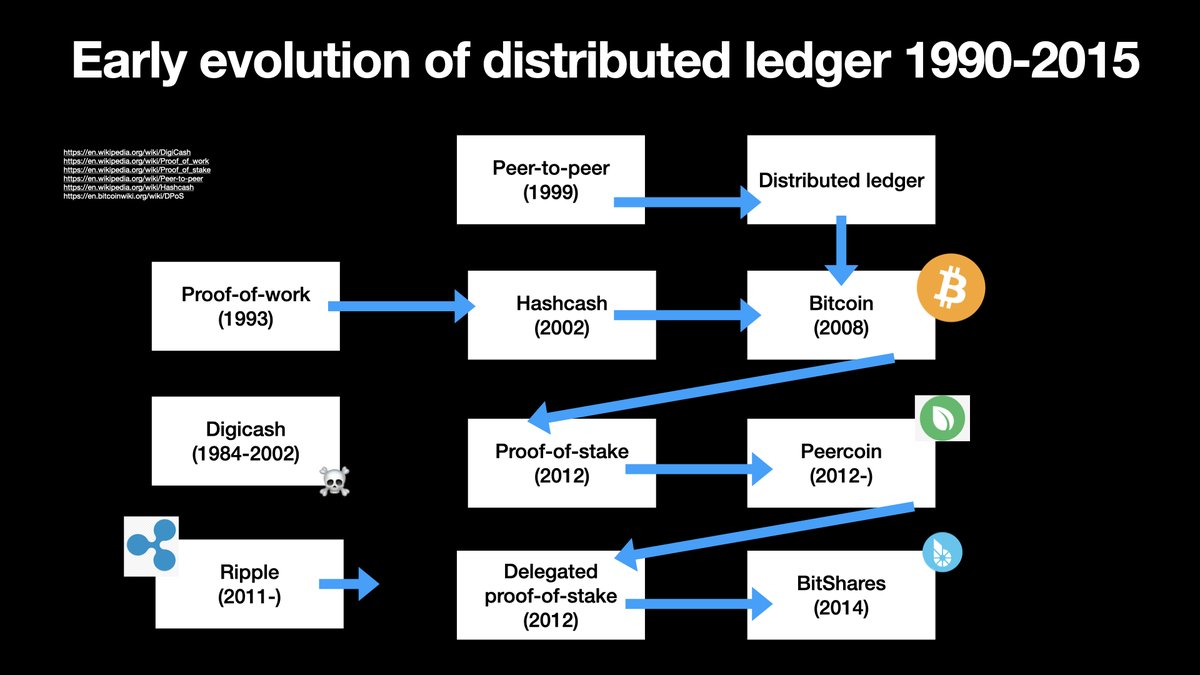

17/ Three key ingredients lead to the creation of #Bitcoin: P2P network, proof-of-work or distributed ledger.

18/ The most well-known of them is peer-to-peer networking. It was infamously successful in the early 00s by enabling the widespread piratism of music and movies.

Instead of having a central server which is easy to take down the data is distributed across all the network.

Instead of having a central server which is easy to take down the data is distributed across all the network.

19/ The 2nd innovation is proof-of-work, already proposed in the early 90s as a way to combat email spam, later this evolved to HashCash.

By attaching the required few hashes of proof-of-work for every inbound email, making sending emails would become too costly for spammers

By attaching the required few hashes of proof-of-work for every inbound email, making sending emails would become too costly for spammers

21/ Sadly, proof-of-work as spam prevention never took off. We ended up with a broken email delivery system where few big ones (Google, Outlook) dominate which email gets delivered or not. There are no fair rules for spam and it is very difficult to run your own email server.

22/ The distributed ledger was the sole innovation of Satoshi Nakamoto. Basically, account balances are distributed in a blockchain and then you use your private key to sign any outbound transaction from your account.

I am not aware of earlier implementations.

I am not aware of earlier implementations.

24/ Bitcoin was soon followed by @Ripple. Ripple follows a separate evolution path.

ripple.com/files/ripple_c…"

25/ The next major breakthrough in the technical evolution of blockchains is @PeercoinPPC.

It had become obvious that proof-of-work is quite an energy hog. All energy going to solving those hashes can be seen as waste if it can be avoided.

PeerCoin presented proof-of-stake.

It had become obvious that proof-of-work is quite an energy hog. All energy going to solving those hashes can be seen as waste if it can be avoided.

PeerCoin presented proof-of-stake.

26/ All those clickbait headlines that ""BITCOIN CONSUMES MORE ENERGY THAN LATIN AMERICA AND GOOGLE COMBINED"" are kind of true, but kind of bollocks as well.

We had the energy consumption of cryptocurrencies solved by Peercoin already back in 2012.

We had the energy consumption of cryptocurrencies solved by Peercoin already back in 2012.

27/ The last technical evolution step of early blockchain history was the invention of delegated proof-of-stake (DPoS).

28/ @bitsharesorg by @bytemaster7 was the first blockchain using delegated proof-of-stake in 2014.

Today, all modern blockchains follow a variation DPoS model. An active smaller set of block producers are chosen by delegating votes. This makes consensus decisions faster.

Today, all modern blockchains follow a variation DPoS model. An active smaller set of block producers are chosen by delegating votes. This makes consensus decisions faster.

29/ The difference between proof-of-stake and delegated proof-of-stake is explained in this excellent post @ShaanRay

hackernoon.com/the-difference… by

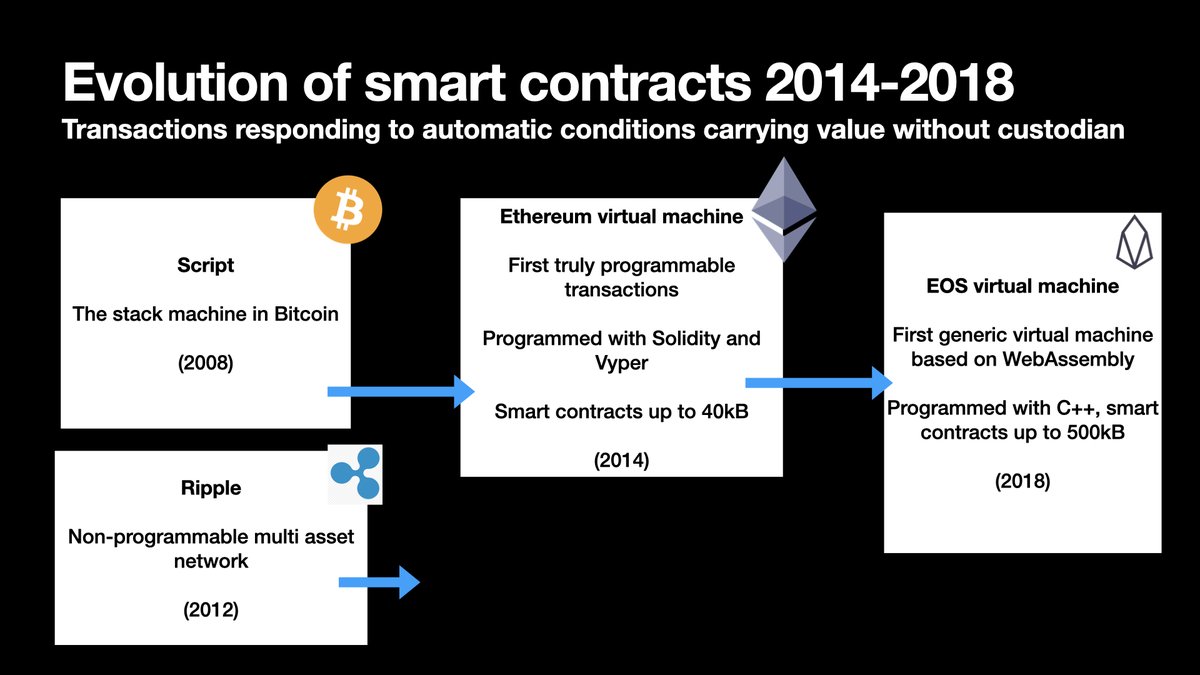

31/ #Bitcoin itself has a programming language called "Script". You can "program" transactions in Bitcoin, but it is very limited what you can do with Script.

This is why there is no #DeFi on Bitcoin. en.bitcoin.it/wiki/Script

This is why there is no #DeFi on Bitcoin. en.bitcoin.it/wiki/Script

32/ #Ethereum pushed the envelope further by introducing "true" smart contracts.

These smart contracts had storage which then could enable use cases like tokens and DEXes.

These smart contracts had storage which then could enable use cases like tokens and DEXes.

33/ @VitalikButerin originally proposed upgrades to Mastercoin (now @Omni_layer) that runs on the top of Bitcoin. However, Mastercoin community perceived these changes as too radical and risky, which then lead to the creation of Ethereum as a separate project.

34/ In hindsight, this was good for the rapid evolution of Ethereum.

There has not been much innovation going in Bitcoin, or it has been snail-paced.

There has not been much innovation going in Bitcoin, or it has been snail-paced.

35/ Also note that Ripple, and its cousin @StellarOrg, never got into the smart contracts. While they pioneered DEXes and multiple assets on-chain, both are "fixed pipeline" blockchains that can only transfer value, not do anything smart on it.

36/ Ethereum created its own environment for running smart contracts called Ethereum Virtual Machine (EVM). There are many "virtual machines" in the programming world to make programs portable across different computers.

You might have heard of Java VM or Python VM.

You might have heard of Java VM or Python VM.

37/ EVM and its programming language @soliditylang are very use case focused and narrow. They can do little computing, slowly, similar to a dumb phone from 1999.

37/ EVM and its programming language @soliditylang are very use case focused and narrow. They can do little computing, slowly, similar to a dumb phone from 1999.

38/ The last step in smart contract evolution was EOS, again by @bytemaster7. EOS uses #WebAssembly run-time, allowing to use of generic programming languages (C++) with generic compiler backend (LLVM). Genericity brings the ecosystem cost down, enabling faster innovation.

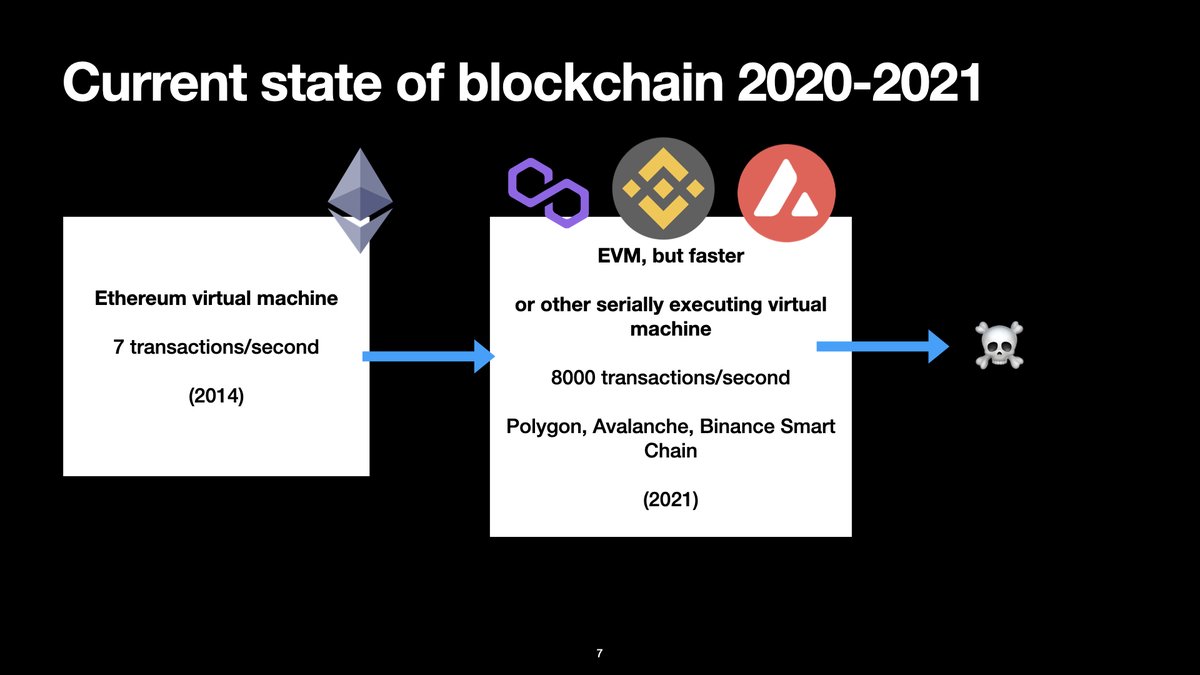

39/ We are now living in 2021. The current state of public blockchains (which run cryptocurrencies) is that Ethereum 1.0, with its proof-of-work, is still dominating.

39/ We are now living in 2021. The current state of public blockchains (which run cryptocurrencies) is that Ethereum 1.0, with its proof-of-work, is still dominating.

40/ In 2020, multiple "EVM clones" that replace proof-of-work with delegated proof-of-stake spawned: @0xPolygon, @Binance Smart Chain, @avalancheavax.

There had been EVM clone attempt earlier like @RSKSmart and @Tronfoundation but none of these became hugely popular.

There had been EVM clone attempt earlier like @RSKSmart and @Tronfoundation but none of these became hugely popular.

41/ But EVM tech can do only so much. Without fundamentally changing the architecture, you are going to hit the limits sooner or later. The upper limit of the speed is around 2000 tx/s. We already had an incident when Binance Smart Chain "blocks become full".

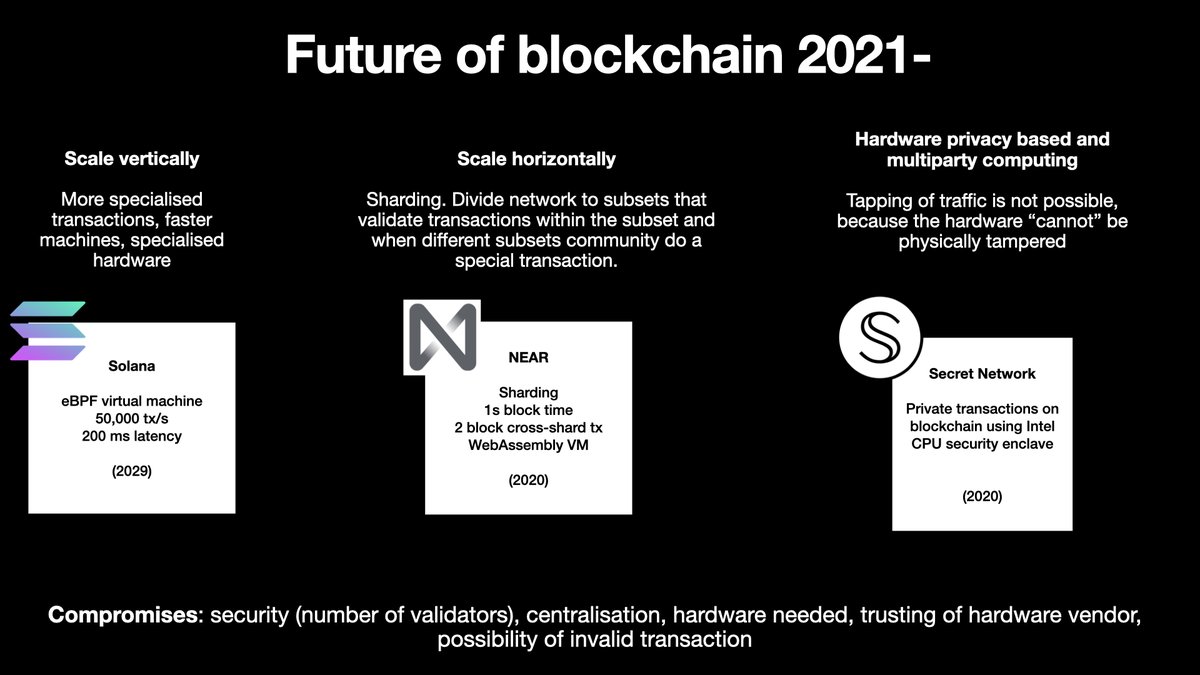

42/ Luckily, we already have a theoretical understanding of how to break these limitations and make blockchains scale further. And we have some of these blockchains already in production.

42/ Luckily, we already have a theoretical understanding of how to break these limitations and make blockchains scale further. And we have some of these blockchains already in production.

43/ @solana aims to take delegated proof-of-stake to its upper limit by optimising software and hardware architecture. E.g. how fast a synchronous blockchain where all nodes process all transactions go.

They claim 50k tx/s.

They claim 50k tx/s.

44/ @NEARProtocol is one of the leading efforts using the sharded approach. Instead of having a synchronous network, there are multiple equal networks (shards) that asynchronously transfer value between each other.

This is how large databases (Google, etc.) scale - by sharding

This is how large databases (Google, etc.) scale - by sharding

45/ Then there are some truly alternative approaches. A lot of privacy focused research happens e.g. @secretnetwork

Their value promise is that the blockchain code runs on the secure element of Intel CPUs. What happens inside the CPU cannot be tapped and it keeps it secure.

Their value promise is that the blockchain code runs on the secure element of Intel CPUs. What happens inside the CPU cannot be tapped and it keeps it secure.

46/ (There is also tons of other interesting aspects of current and future blockchain research, but need to limit the content here. E.g. fixed-function/non-smart blockchains like X-Chain from @avalancheavax. Please drop a tweet if you want to know or discuss more.)

47/ Now let's talk about cultural aspects

47/ Now let's talk about cultural aspects How crypto projects and communities have evolved; what kind of waves there have been and will be?

👇👇👇

48/ We all know it started with #Bitcoin.

48/ We all know it started with #Bitcoin.Bitcoin is the most valuable cryptocurrency because being the first it has so much trust momentum behind it. Countless years without failures and being stable. It can be trusted by most conservative audiences.

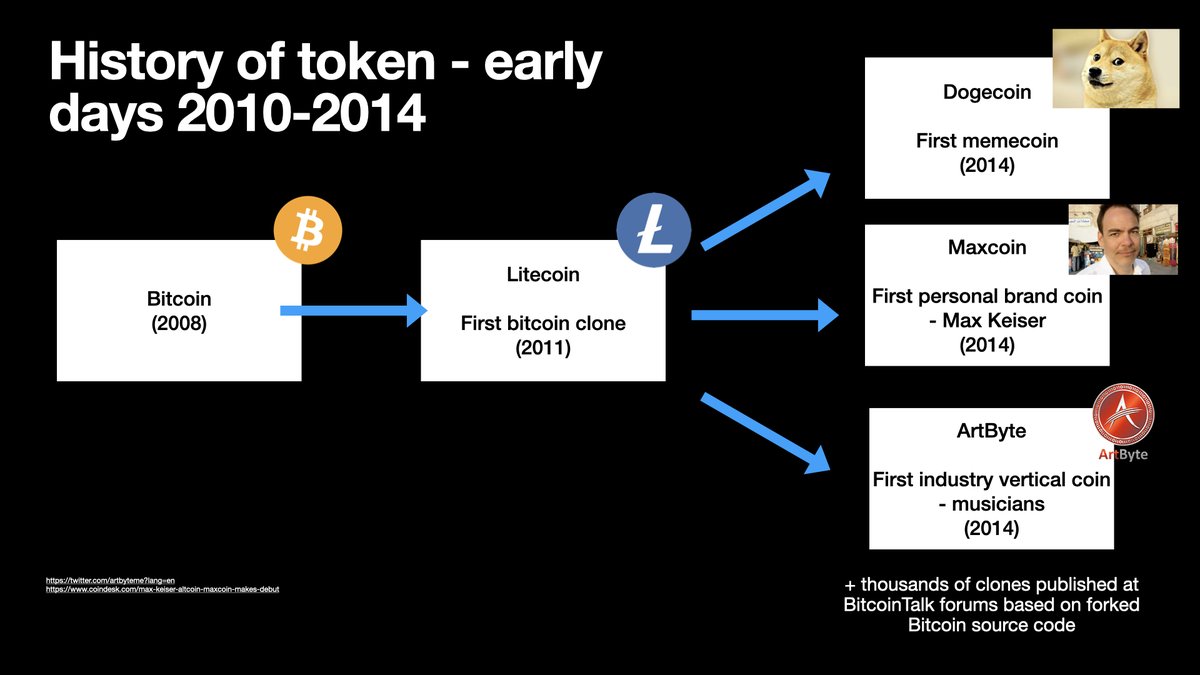

49/ But can Bitcoin be improved? This question was asked already far back in the early years.

The first "fork" of Bitcoin was @litecoin in 2011 by @satoshilite.

Forking is a term for cloning an #opensource codebase.

The first "fork" of Bitcoin was @litecoin in 2011 by @satoshilite.

Forking is a term for cloning an #opensource codebase.

50/ Litecoin essentially took all the source code of Bitcoin, search and replaced name, changed the hashing algorithm from SHA-256 to scrypt, changed block time and inflation

en.wikipedia.org/wiki/Litecoin

51/ It was only a few source code lines of change, could be done in few days, so whether we can call this original work innovation or not is left for the reader to judge.

But what it did culturally cannot be underestimated.

But what it did culturally cannot be underestimated.

52/ People figured out "oh wow, ANYONE can create their own cryptocurrency", because open sourced Bitcoin is easy to fork.

People figured out there is easy money to be milked from investors by trying to replicate the early Bitcoin value appreciation with "scarcity."

People figured out there is easy money to be milked from investors by trying to replicate the early Bitcoin value appreciation with "scarcity."

53/ And oh boy people went raided their cutlery and forks were out...

I call the period of 2012-2015 the original altcoin years.

Originally term altcoin was coined to mean any Bitcoin clone.

@BitcoinTalk, the largest community forum was filled with these forks.

I call the period of 2012-2015 the original altcoin years.

Originally term altcoin was coined to mean any Bitcoin clone.

@BitcoinTalk, the largest community forum was filled with these forks.

54/ Unlike tokens today, creating an altcoin meant you had to run your own blockchain, all from the genesis block, yourself, with proof-of-work mining.

Luckily mining with CPU was still a thing by the time.

Giving yourself some extra coins at the start was called "premine."

Luckily mining with CPU was still a thing by the time.

Giving yourself some extra coins at the start was called "premine."

55/ You might have heard some of the original altcoins, but most are obscure by today. I have picked some examples I personally remember.

56/ the #DogeCoin still goes strong. It might not be the first meme coin, but it is the most successful one, originally created to mock cryptocurrency community.

Dogecoin technical parameters are so ridiculous that its blockchain barely works.

Dogecoin technical parameters are so ridiculous that its blockchain barely works.

57/ The famous sound money proponent @maxkeiser was the first one to create a personally branded blockchain "MaxCoin" in 2014, though it is unclear for me how involved he was in the project.

coindesk.com/max-keiser-alt…

48/ There were also early attempts of industry vertical coins like @artbyteme - a coin for artists musiciansand mucisians

59/ But having a token AND blockchain AND mining for it did indeed not make a lot of sense.

Like MaxCoin, most of these altcoins went the way of the dodo, because they did not create any value.

Dogecoin stayed because it was a bad joke and bad jokes do not die easily.

Like MaxCoin, most of these altcoins went the way of the dodo, because they did not create any value.

Dogecoin stayed because it was a bad joke and bad jokes do not die easily.

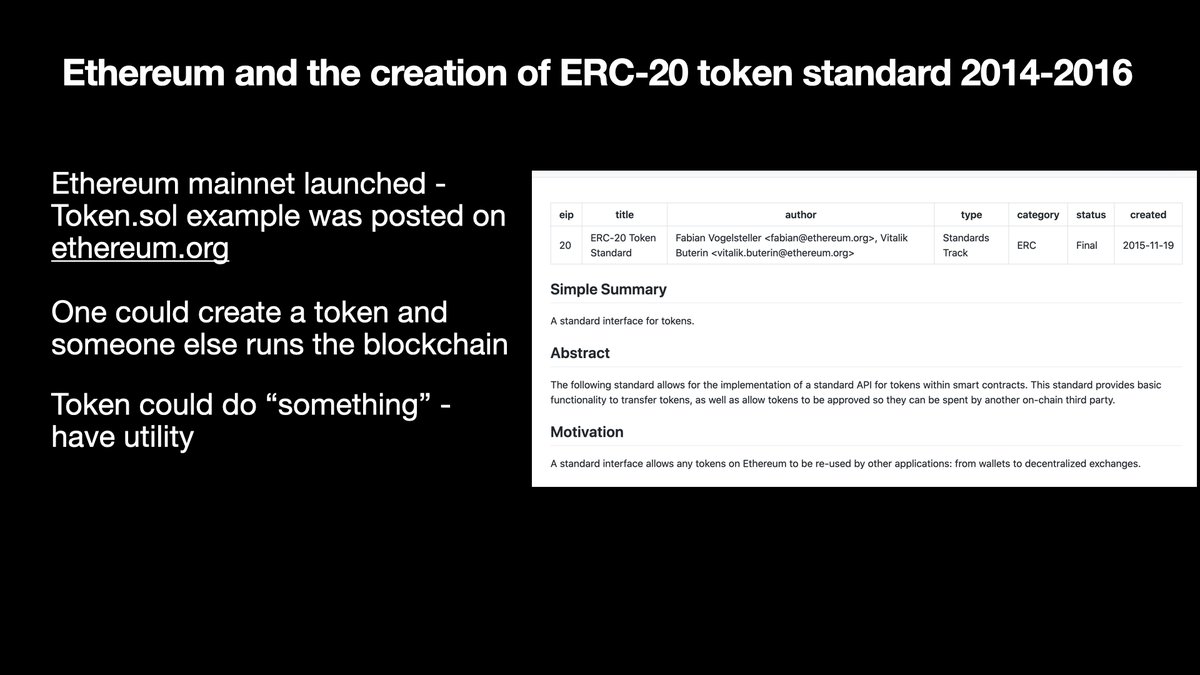

60/ Then, the launch of #Ethereum in 2015, was a game-changer.

60/ Then, the launch of #Ethereum in 2015, was a game-changer.Creating a new token did no longer needed running your own blockchain.

Pre-ERC-20 token contract Solidity source code was posted as an example for people to fiddle.

61/ These tokens also had theoretical "utility". You could wire smart contracts in a way that token is required to do something, or it does something.

The utility token was born.

The utility token was born.

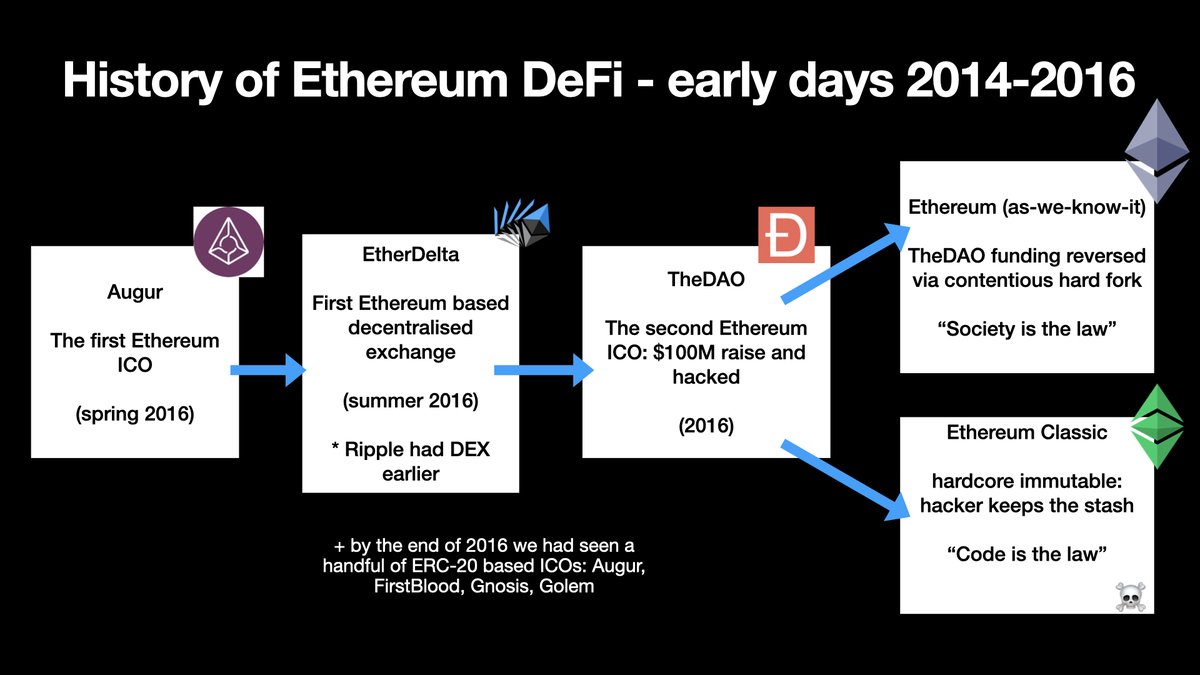

64/ @AugurProject was the first Ethereum ICO. Their token had utility in the Augur prediction market.

64/ The infamous TheDAO was the second one during the early summer of 2016. It was the original "DAO as a venture capital fund" model. More about the infamous bit later.

en.wikipedia.org/wiki/The_DAO_(…

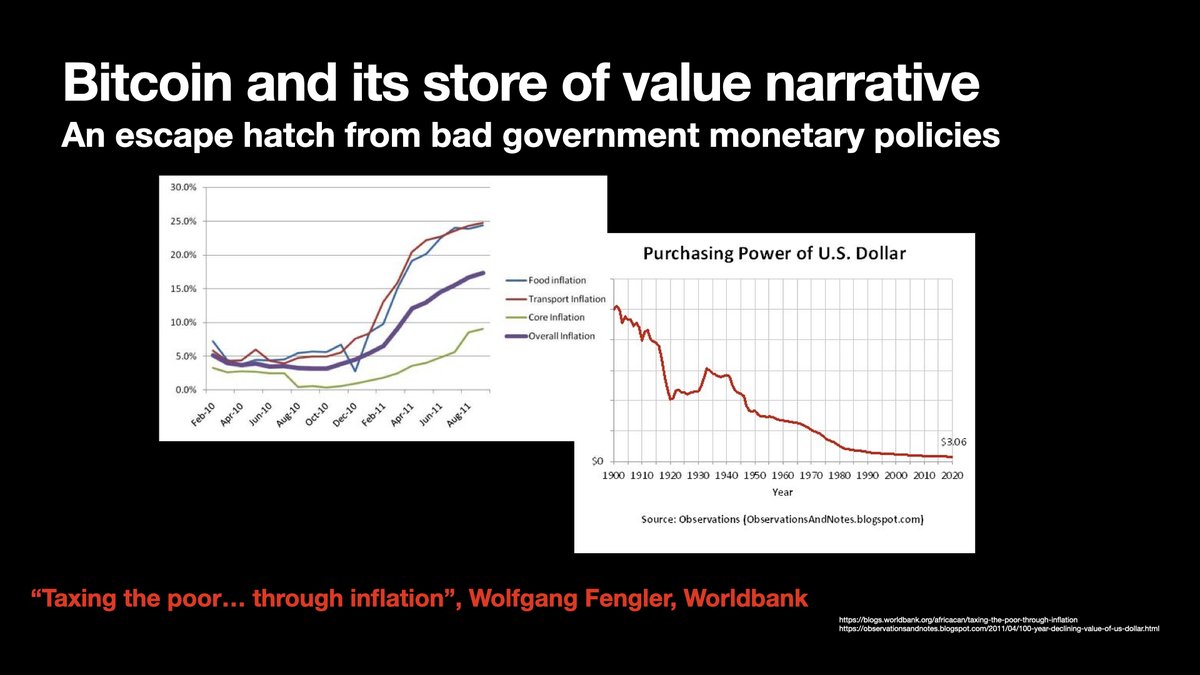

65/ Then we had @firstblood in September 2016 where I had the honour to serve as an auditor (the audit industry did not yet exist by the time) and then later as CTO in 2020.

FirstBlood token now lives as @DawnProtocol

FirstBlood token now lives as @DawnProtocol

66/ We also got another prediction market ICO @GnosisPM which spun off from @consensys - an early Ethereum ecosystem investment arm by @ethereumJoseph

67/ The fourth notable 2016 ICO was @golemproject that introduced the concept of using a token for computer time sharing (mainly useful for offloading 3D rendering, etc. for third party machines)

68/ But 2016 was not an easy year. Ethereum smart contract execution parameters, or so-called opcodes, were not yet finely tuned. This resulted in the network being under constant Denial-of-Service "Shanghai" attacks in Autumn 2016.

coindesk.com/so-ethereums-b…"

69/ Not only this, but TheDAO team screwed it up. They raised too much money ($100M) with too little security. As I said, there were not really auditors back in the day.

$100M in ETH was very notable by the time. Now this $ETH would be worth of around $30B - $50B."

$100M in ETH was very notable by the time. Now this $ETH would be worth of around $30B - $50B."

70/ Even though the screw up was caused by the TheDAO members, it was up to the community to decide how to clean up. Leaving such a big stash in the hands of a single hacker would be a future systematic risk for the network security, especially when moving to proof-to-stake.

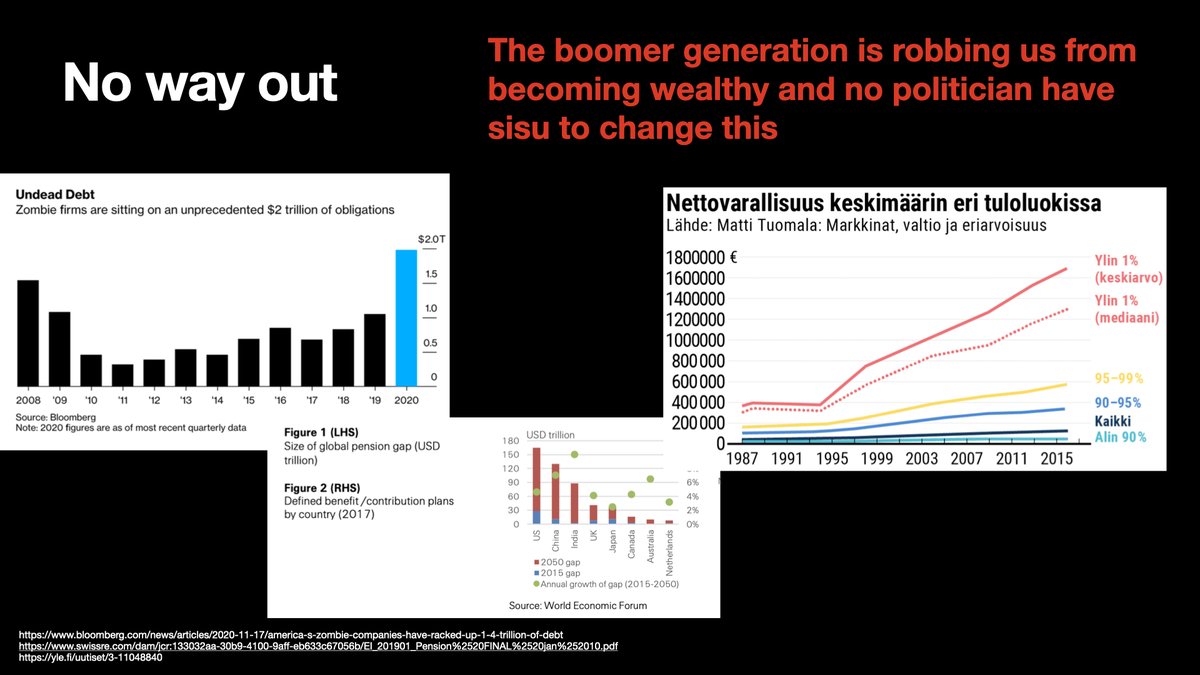

71/ (Sidenote: In 2016, the #Ethereum community was optimistic they will transition to proof-of-stake in 2017. Turns out, it was not that easy.)

72/ Ethereum community was divided into those who were pragmatists: "Let's unwind the TheDAO mess with a hard fork." The opposite side was "code is the law" folks, the puritans.

73/ The sides could not agree, so into #Ethereum network split to two through the non-cooperative, social, fork.

Some miners continued one chain, while the others continued another.

Some miners continued one chain, while the others continued another.

74/ Ethereum, as you know today, is the fork of pragmatists and was promoted by the @Ethereum Foundation.

Puritan work, @EthereumClassic ($ETC), is not much a player today, in the terms of activity.

Turned out code is not the law, but the social consensus is the law.

Puritan work, @EthereumClassic ($ETC), is not much a player today, in the terms of activity.

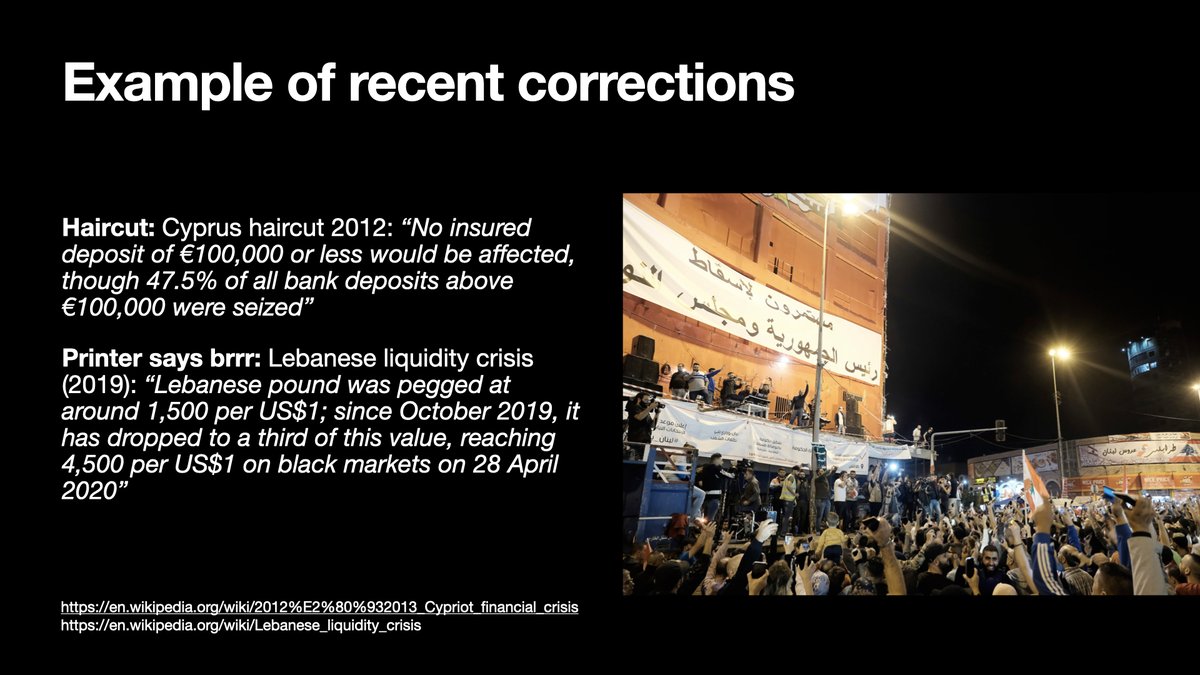

Turned out code is not the law, but the social consensus is the law.

75/ Because of the so-called "irregular state change" to unwind the TheDAO crowdfunding, #Ethereum got a bad reputation for the next few years.

"Blockchain is supposed to be immutable, or it is a joke" puritans toted.

"Blockchain is supposed to be immutable, or it is a joke" puritans toted.

76/ This also led to some bad blood. For example, the founder @DCGco, @barrysilbert, owned huge bags of $ETC. He also happened to own the number one news site in the industry, @coindesk.

@coindesk was cold and hostile towards #Ethereum for years to come.

@coindesk was cold and hostile towards #Ethereum for years to come.

77/ But we quickly moved on from TheDAO mess. Early 2017 $ETH, which dipped as low as $5/ETH, started to pump again.

The late 2016 ICOs had been very successful. They were sold out in minutes.

People had taken notice.

The late 2016 ICOs had been very successful. They were sold out in minutes.

People had taken notice.

78/ 2018-2018 were the utility token years.

78/ 2018-2018 were the utility token years. What had been the original altcoin boom was now replicated on #Ethereum.

Different ICOs started to pop out left and right. Some of them made sense, most of them not.

79/ ICOs were a gamer changer in a few "never befores"

... there had been an option to raise money from the global audience

... immediately liquidity for your investment

... professional (VC) and retail investors able to get the same terms

... there had been an option to raise money from the global audience

... immediately liquidity for your investment

... professional (VC) and retail investors able to get the same terms

80/ ICOs were "fairer" in a sense, compared to other startup funding channels.

But also, a lot of them were neutered because they had to circumvent the security laws, mostly in the US, as anything being securities cannot trade on a cryptocurrency exchange.

But also, a lot of them were neutered because they had to circumvent the security laws, mostly in the US, as anything being securities cannot trade on a cryptocurrency exchange.

81/ A lot of utility tokens had marginal utility, but no investor protection, because they looked to skirt the securities laws.

Fundamentally, unless you have discounted cash flows, your investment is not worth much. The artificial scarcity argument takes you only so far.

Fundamentally, unless you have discounted cash flows, your investment is not worth much. The artificial scarcity argument takes you only so far.

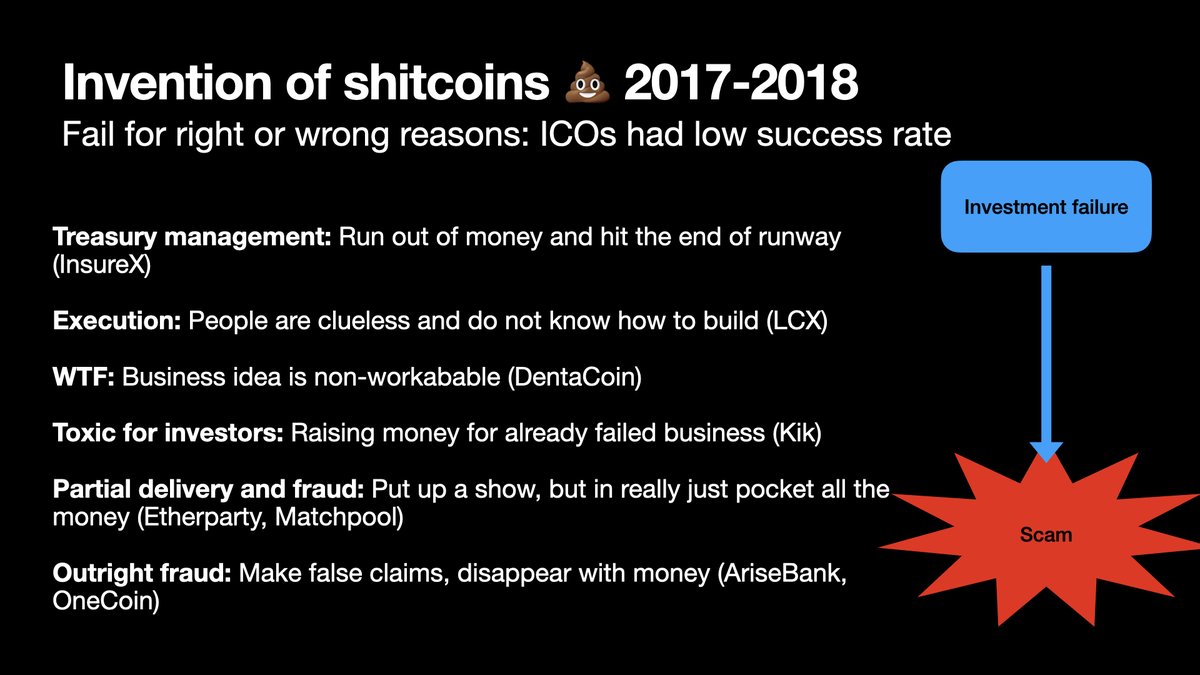

82/ The ICO craziness led to the creation of the term "shitcoin."

82/ The ICO craziness led to the creation of the term "shitcoin."A worthless token that failed or is likely to fail.

I believe I have helped to create more shitcoins than anyone else on this planet.

83/ But tokens can fail forhigh-quality right or wrong reasons. A lot of high quality projects had difficult years during the upcoming crypto winter when the industry crawled back to its shell.

Here are some of my examples and observations of why ICO tokens failed:

Here are some of my examples and observations of why ICO tokens failed:

84/ A common reason to fail was bad treasury management. Despite raising millions of dollars in $ETH, stablecoins were not yet a thing in 2017. Banks did not bank ICOs. You could not diverse your assets.

ETH dipped to 1/10th and suddenly your big raise was not that big.

ETH dipped to 1/10th and suddenly your big raise was not that big.

85/ Then we have execution failures. A lot of projects, despite raising all the money in the world, have not been able to deliver.

85/ A good example of bad execution is the Tron blockchain of @tronfoundation. They raised billions. Tron could have been what Polygon, Binance Smart Chain and other EVM clone chains combined are today.

86/ But turns out, Tron's dictator founder, @justinsuntron, is not a very good executive. Lack of formal education in management, lack of integrity and lack of technical knowledge does not make a good leader.

theverge.com/21459906/bitto…"

87/ Copy-pasting the Ethereum whitepaper and raising billions from Chinese might have had better success if Justin had understood his own shortcomings and hired a capable management team and stepped down. But this is not what narcissists do.

coincentral.com/community-accu…"

88/ Then we had ICOs that just do not make sense and it does not take a Master of Business Administration degree to tell it.

@dentacoin - let's create money for dentist services. coingecko.com/en/coins/denta…

@dentacoin - let's create money for dentist services. coingecko.com/en/coins/denta…

89/ We also had some failed businesses using ICO as a "Hail Mary" fundraising method, because professional investors could not see the end of the tunnel anymore and the company could not raise money through conventional means.

90/ The most notable one is @Kik messenger, known for its dirty self destructing video messages, serving exhibitionist audiences.

theverge.com/2019/6/5/18653…

91/ (In other notes, looks like @Kin_Ecosystem is doing ok and have survived even through its battle with The SEC. I would not have bet on this outcome, but I am happy for it.)

coingecko.com/en/coins/kin

92/ Then we are moving to outright fraud, or "true scam" ICOs. Sadly, this category was crowded.

A lot of projects raised money with real promises, no lies there but never planned to deliver.

A lot of projects raised money with real promises, no lies there but never planned to deliver.

93/ One of the more well-known is @etherparty_com. The founders put up a good show of showing that something would be delivered but it looks like the raised money ended up on personal accounts and in Canadian real estate.

thenextweb.com/news/vanbex-cr…

94/ EtherParty investors included some big, well-known names, so having a large investor backing you does not mean the project is not outright fraud.

95/ Another one is @matchpool - dating service with its own crypto.

We can give the benefit of the doubt for the business idea, like with Kin, but looks like the Israeli founder moved forward from his home country, taking the raised money stash with him.

We can give the benefit of the doubt for the business idea, like with Kin, but looks like the Israeli founder moved forward from his home country, taking the raised money stash with him.

96/ And then we have outright frauds. Ponzis, scams, etc. where involved people lie left and right. Raise as much as possible and disappear on the following day.

A lot of these were run by convicted criminals with new aliases.

A lot of these were run by convicted criminals with new aliases.

But some investors were not that lucky. One of the infamous cases is OneCoin which goes as far as back 2014, raised $4B and founders managed to disappear with the money in 2017

investopedia.com/terms/o/onecoi…

99/ Another in the category "how in the world was this possible" is PlusToken that raised $4B from 2.6 million Chinese investors. They even advertised on national TV before the news.

100/ Though the Chinese news says that "money was seized" we do not have any on-chain evidence for this. I personally believe at least some ringleaders managed to make it out with some stash.

coingeek.com/plustoken-scam…"

101/ 2018 did not end that well for the crypto. A lot of mistakes were made, a lot of money was lost.

101/ 2018 did not end that well for the crypto. A lot of mistakes were made, a lot of money was lost.Years 2018-2019 are called "crypto winter" because we saw a massive correction in cryptocurrency prices. The industry fell into hibernation.

102/ The euphoria had been replaced by sadness and hangover. Cryptowinter was lean, not flashy, period.

“Steel is strong because it knew the hammer and white heat.”

Cryptowinter was the time of building.

#buidl hashtag appeared along with the popular #hodl meme

“Steel is strong because it knew the hammer and white heat.”

Cryptowinter was the time of building.

#buidl hashtag appeared along with the popular #hodl meme

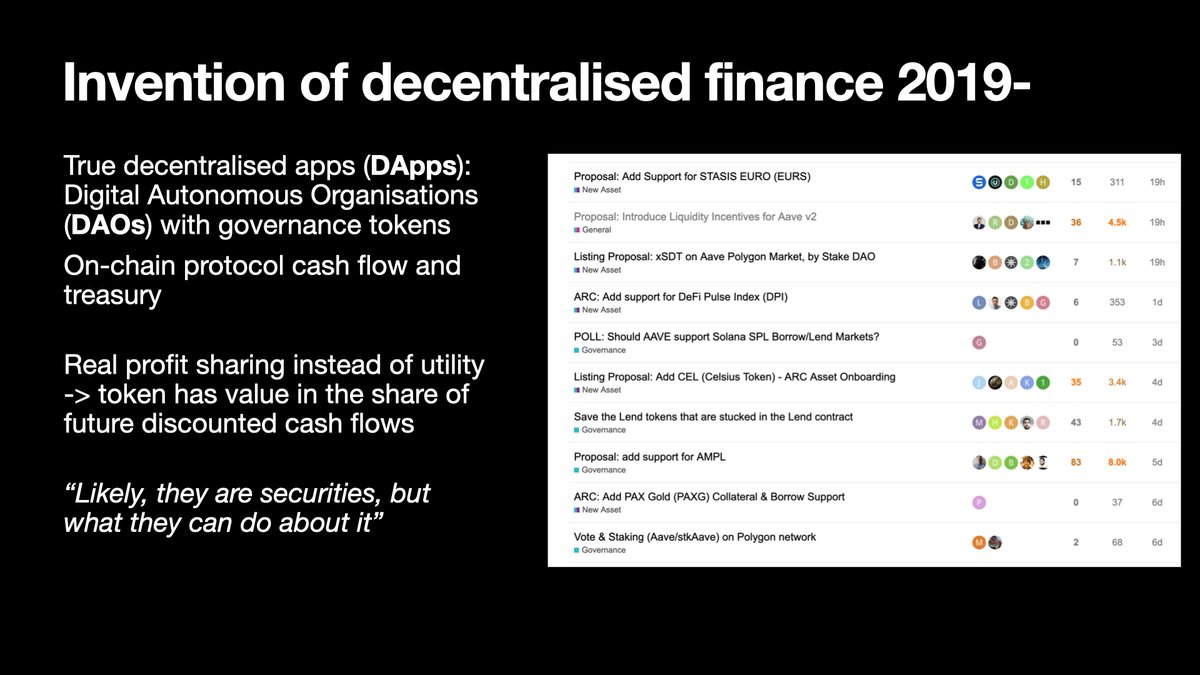

103/ Instead of utility tokens, people started to talk about decentralised finance or #DeFi for short.

103/ Instead of utility tokens, people started to talk about decentralised finance or #DeFi for short.A true DeFi protocol has few major differences for ICOs and utility token boom:

104/ DeFi tokens focus around protocols where most, if not all, actions happen through smart contracts on a blockchain.

There are no centralised element into which token holders would not have visibility.

There are no centralised element into which token holders would not have visibility.

105/ There is on-chain governance through Digitally Autonomous Organisations (DAOs). Instead of founders deciding where the money goes, the token holders decide it through voting.

The treasury and cash flows are transparent on-chain.

The treasury and cash flows are transparent on-chain.

106/ There is a real profit-sharing element for token holders, instead of artificial scarcity arguments that were present in utility tokens.

As a holder of the governance token of a DeFi protocol, you earn dividends or yields.

As a holder of the governance token of a DeFi protocol, you earn dividends or yields.

107/ Instead of having an ICO, tokens are distributed through liquidity mining. People need to put their capital into work and earn tokens, instead of buying them.

(Though you can still buy on the secondary market, it puts the project itself at less direct legal risk.)

(Though you can still buy on the secondary market, it puts the project itself at less direct legal risk.)

108/ Tokens are traded on permissionless decentralised exchanges like @SushiSwap and @Uniswap, instead of centralised exchanges with identity verification, membership limitations and token listing fees.

109/ "Wait... but does this sound like it is violating the security laws, especially the notorious US Howey Test?"

My answer is highly likely.

My answer is highly likely.

110/ The question, as my lawyer friend, spelt it out, "But what are they going to do about it?"

Because the DeFi protocol tokens ownership is "sufficiently decentralised" as the @SEC_News would put it.

Because the DeFi protocol tokens ownership is "sufficiently decentralised" as the @SEC_News would put it.

111/ In theory, someone can go after DeFi protocol developers, marketers and website hosting and take them down. But because the actual protocol, and treasury, lives on a blockchain, token holders can just elect new developers and move the hosting elsewhere.

113/ Also, there is my "no harm done" rule: if #DeFi is executed correctly, there is little room for fraud, as actions can be confirmed on-chain.

114/ There is little room for insider trading because the development happens open source and most of the information is public at the moment is created.

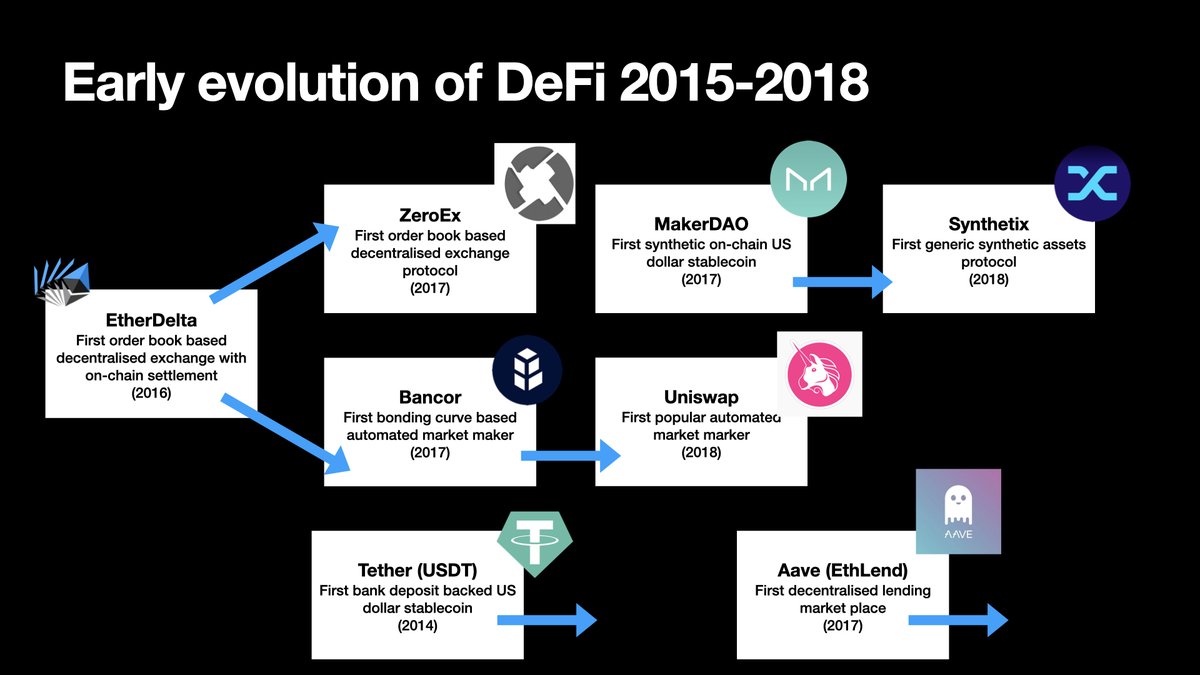

116/ The first decentralised exchange, on Ethereum, was @etherdelta.

Unfortunately, it did not have much time to become decentralised enough. The SEC settled with its founder, Zach Coburn.

The exchange was sold and new Chinese owners had no idea how to execute.

Unfortunately, it did not have much time to become decentralised enough. The SEC settled with its founder, Zach Coburn.

The exchange was sold and new Chinese owners had no idea how to execute.

117/ EtherDelta led to the development of other order book trading based protocols with on-chain settlements. @0xproject and @KyberNetwork are the most famous ones.

118/ However, Ethereum is not efficient enough to run order books on-chain. You still need centralised servers from where you fetch the list of orders you can fill.

(Sidenote: EOS, Solana, NEAR can run full on-chain order book based DEXes)

(Sidenote: EOS, Solana, NEAR can run full on-chain order book based DEXes)

119/ The first project to have pure on-chain trading was @Bancor in 2017. Instead of the order book, it used "bonding curves" that set the price based on mathematical formulae based on ask and bid supply. This data was simple enough that #Ethereum smart contracts could process it

120/ This model of bonding curve and liquidity pool based on-chain exchanges was later named as "Automated Market Maker" (AMM) model.

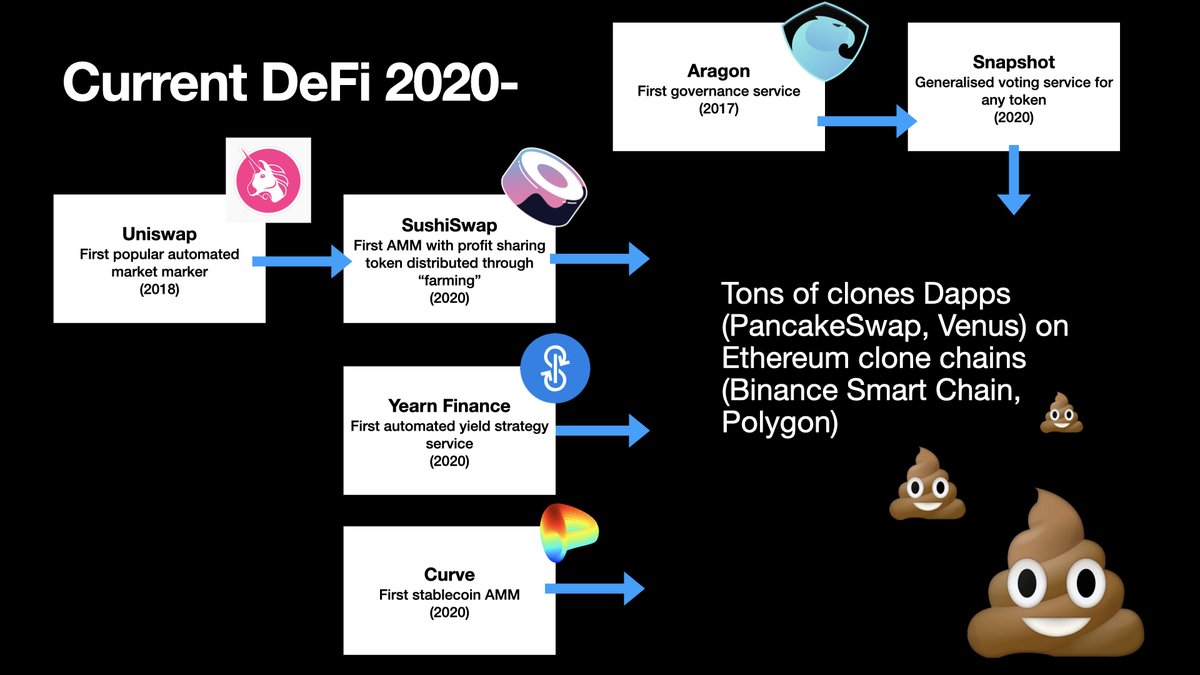

121/ Then, in late 2018, @uniswap was created with a grant from @ethereum foundation.

Uniswap was effectively "Better Bancor, without a vested interest utility token."

Uniswap became very, very, popular.

Uniswap was effectively "Better Bancor, without a vested interest utility token."

Uniswap became very, very, popular.

122/ We also saw the first so-called synthetic asset, $DAI dollar stablecoin from @makerdao in 2017.

A synthetic asset tracks the price of a real-world asset (USD), but instead of being backed by dollars on a bank account it is backed large enough collateral of crypto on-chain

A synthetic asset tracks the price of a real-world asset (USD), but instead of being backed by dollars on a bank account it is backed large enough collateral of crypto on-chain

123/ The main benefits of synthetic on-chain assets are that the collateral is transparent (risk is well understood), it is permissionless (anyone can buy it) and it can be integrated with other decentralised finance components.

125/ Later, @synthetix_io took the idea of synthetic assets even further in 2018, allowing you to create markets for any asset.

This includes other cryptocurrencies (#bitcoin), commodities like oil, but also equities like Tesla.

This includes other cryptocurrencies (#bitcoin), commodities like oil, but also equities like Tesla.

126/ We also saw the rise of bank account backed stablecoins. @Tether_to, the most famous asset-backed stablecoin, goes all the way back to 2014 but did not become that popular until the 2019 #DeFi wave began.

127/ We also saw the rise of decentralised lending. @AaveAave, originally started as a 2017 ICO under the name EthLend.

Almost killed by a crypto winter, Aave is now a DAO behemoth with more than $16B assets under management, bigger and safer than most banks.

Almost killed by a crypto winter, Aave is now a DAO behemoth with more than $16B assets under management, bigger and safer than most banks.

129/ @CurveFinance took the automated market maker (AMM) model and applied it stablecoins. E.g. if you want to swap between $DAI and $USDT (both around 1:1 to US Dollar) you can do it with little slippage on Curve.

130/ @sushiswap executed its famous "vampire attack" on @uniswap and started the wave of Uniswap clones, which then popped up like mushrooms in rain.

capitalgram.com/posts/uniswap-…

131/ @iearnfinance was the first "automated yield service for your assets.

Instead of you trading your assets yourself, you deposit them in a Yearn smart contract which will hunt the best yield for you.

Instead of you trading your assets yourself, you deposit them in a Yearn smart contract which will hunt the best yield for you.

132/ @AragonProject was an early 2017 project that builds governance tools for DAOs. It was followed by Snapshot, a spin-off from @BalancerLabs, becoming the de facto governance and voting portal for #DeFi.

snapshot.org

133/ Then, the history rhymes again. Like during the years of the original altcoin boom, we are seeing clones popping out left and right.

Mostly anonymous founding team.

Mostly with little promise how they are going to create value.

But cloning is easy.

Mostly anonymous founding team.

Mostly with little promise how they are going to create value.

But cloning is easy.

134/ This has also led to the creation of a new word: "rug pull."

It is the same as a scam, but you do not disappear overnight. Anonymous founders disappear after the cloned service they have launched gets "hacked."

It is the same as a scam, but you do not disappear overnight. Anonymous founders disappear after the cloned service they have launched gets "hacked."

135/ Anonymous founders just leave a back door for themselves to steal customer assets after they have massed enough assets under management.

136/ Where do we go from here in 2022-2023?

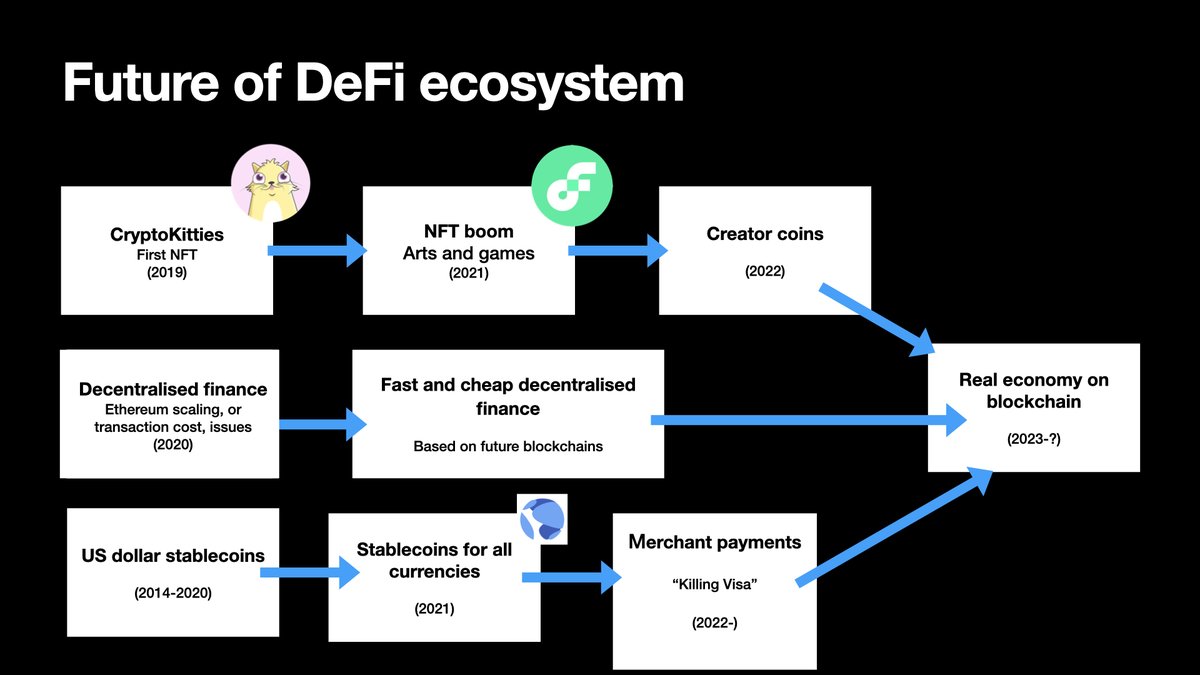

136/ Where do we go from here in 2022-2023?We are now living in an NFT boom. It has similar characteristics to the ICO boom. The value promise of a lot of projects lacks fundamentals. It is likely the whole NFT industry experiences severe devaluation.

137/ Personally I believe the next continuum after NFTs is "creator coins." Revenue sharing instruments for creators that allow themselves to sell shares in their work or its future income.

138/ next-genThe next gen blockchain technology like @nearprotocol and @solana are making DeFi cheaper. We hit a tech scalability wall in 2020, but we know how to overcome it. This will make #DeFi replace even more centralised use cases.

139/ Stablecoins have come here to stay. What we have seen to happen with the US dollar will be replicated across all the world currencies, by ones like @terra_money

140/ Eventually, we have enough on-chain currencies and liquidity to start fulfilling the original #Bitcoin whitepaper promise:

Digital peer-to-peer cash

Digital peer-to-peer cash

141/ This, in turn, will result in merchant adoption of digital currencies and will slowly start to bring real-world revenue streams, i.e. non-crypto business, on-chain.

142/ [FIN of culture section]

142/ [FIN of culture section]Now let's talk about macroeconomic aspects.

Technology and culture narratives above show that crypto communities are onto something and we want to understand what this means for the world economy.

👇👇

143/ Macroeconomics mostly focus on #Bitcoin, because Bitcoin is the cryptocurrency with most of the trust backing it up.

143/ Macroeconomics mostly focus on #Bitcoin, because Bitcoin is the cryptocurrency with most of the trust backing it up. World bankers are talking about Bitcoin, they do not talk about $ETH yet.

144/ The 1st fact making public blockchains interesting is that transfer-of-value works 24/7.

Better money for payments: in theory, you do not need to give a due date for your invoices, because the customer should be able to settle them instantly, assuming they are not illiquid

Better money for payments: in theory, you do not need to give a due date for your invoices, because the customer should be able to settle them instantly, assuming they are not illiquid

145/ The second trickis blockchains being non-custodial. You can hold your assets yourself, like you would hold physical property. There is no counterparty risk with the custodian of your assets e.g. your bank.

146/ A lot of regulation have been invented to make sure that when (leveraged) banks go bust (and they do) the small consumers do not suffer.

But this brings little comfort for business-to-business trade that most world trade is.

But this brings little comfort for business-to-business trade that most world trade is.

147/ The third, and the loudest, argument is "sound money." The value of #Bitcoin cannot be inflated away, like the value of any fiat (government-issued currency) can be.

This is especially true in the era of pandemics, because, oh boy, governments are printing money.

This is especially true in the era of pandemics, because, oh boy, governments are printing money.

148/ This brings us to "store of value" narrative.

148/ This brings us to "store of value" narrative.Bitcoin is a better store of value, because it cannot be taken away from you easily, either by confiscation or by inflation.

149/ Government-issued monies, on the other hand, are bad store of value. There is no currency that's purchase power increased in history.

Or... every second you hold your money in a bank it's losing value, faster or slower.

Or... every second you hold your money in a bank it's losing value, faster or slower.

150/ This hurts mostly low-income class people because they do not have free cash reserves or time to invest. They need to hold cash that loses value.

Or opposite... top %1 accumulates more wealth because they have proportionally more to invest.

Or opposite... top %1 accumulates more wealth because they have proportionally more to invest.

151/ "Inflation is tax on poor." I could not find if anyone has ever said these exact a words, but Wolfgang Fengler from Worldbank comes close enough.

blogs.worldbank.org/africacan/taxi…"

152/ an Inflation is issue mostly for developing countries. Kenyans, Turks, Argentinians... they can tell all about how bad the government money is.

And now with the excessive government borrowing spree of pandemics, some expect every country will join this club.

And now with the excessive government borrowing spree of pandemics, some expect every country will join this club.

153/ "Cryptocurrencies are in a bubble, you need to be careful when buying them."

153/ "Cryptocurrencies are in a bubble, you need to be careful when buying them."I agree with this sentiment because the valuations have gone up way too fast.

154/ However, we are in the everything bubble.

Even @ESMAComms - the highest securities authority in the EU, is saying no matter what you are buying, including stocks, you are going to get a very bad deal at the moment.

Even @ESMAComms - the highest securities authority in the EU, is saying no matter what you are buying, including stocks, you are going to get a very bad deal at the moment.

155/ Valuations have been inflated by quantitative easing or money printing.

A friendly, and easy to read, introduction to the topic can be found in this newsletter by @LynAldenContact lynalden.com/quantitative-e…

A friendly, and easy to read, introduction to the topic can be found in this newsletter by @LynAldenContact lynalden.com/quantitative-e…

156/ Valuations are no longer driven by fundamentals - or discounted future cash flows. In most of the assets, prices instead driven by new money buying out old money.

157/ Thus, if you call Bitcoin a ponzi (new money pays out old money), you need to call many other things ponzis as well.

158/ The most notable ponzi is pension funds all around the world. This is called the pension gap.

swissre.com/dam/jcr:133032…

158/ The most notable ponzi is pension funds all around the world. This is called the pension gap.

swissre.com/dam/jcr:133032…

159/ Effectively, our parent generation, or the boomers, have not saved enough money to retire. They need new money constantly flow in to bail out the holders of pensions.

160/ If you are born after 1995 you effectively live in serfdom where you need to serve your parent generation forever to make sure they have a good life as an elderly.

161/ You cannot get rich, because anything you try to buy for investment is overpriced due to money printing to keep the music playing.

162/ No politician will ever make a decision that would correct this situation. Because it is the boomer generation driving politics through voting.

No politician will drive a policy against the establishment that would put them effectively out of power in the next election.

No politician will drive a policy against the establishment that would put them effectively out of power in the next election.

163/ And how large the pension deficit number of $400T is? The wealth of the whole world was $360T in 2019.

visualcapitalist.com/all-of-the-wor…

164/ Thus, people are buying #Bitcoin.

You can call it a pyramid, you can call it fraud, but it is the smaller evil of two. Even if the economic doomsday scenario by implosion were unlikely, there might be a small chance for it happening and it is better to have plan B.

You can call it a pyramid, you can call it fraud, but it is the smaller evil of two. Even if the economic doomsday scenario by implosion were unlikely, there might be a small chance for it happening and it is better to have plan B.

165/ Even more generalised: "Why people are investing in cryptocurrencies... including shitcoins."

Because boomers have robbed generations of having means to become wealthy otherwise; Buyers are buying lottery tickets in hoping it will lift them over the edge.

Because boomers have robbed generations of having means to become wealthy otherwise; Buyers are buying lottery tickets in hoping it will lift them over the edge.

166/ We have plenty of historic and modern examples of what is going to happen when things finally go sour.

166/ We have plenty of historic and modern examples of what is going to happen when things finally go sour.

167/ You can solve some issue by "haircut", like in Cyprus in 2012: “No insured deposit of €100,000 or less would be affected, though 47.5% of all bank deposits above €100,000 were seized”

en.wikipedia.org/wiki/2012%E2%8…

168/ Does not sound that for a consumer, but how about all businesses that needed more than 100k cash in hand?

169/ Then we can look at current Lebanon where the "liquidity crisis" began in 2019.

Lebanese pound was pegged at around 1,500 per US$1; since October 2019, it has dropped to a third of this value, reaching 4,500 per US$1 on black markets on 28 April 2020.

Lebanese pound was pegged at around 1,500 per US$1; since October 2019, it has dropped to a third of this value, reaching 4,500 per US$1 on black markets on 28 April 2020.

170/ It's quite bad when you cannot buy food, fuel and streets are filled out with riots and robber gangs.

en.wikipedia.org/wiki/Lebanese_…

171/ What's going to happen in the short term future?

171/ What's going to happen in the short term future?DeFi is unstoppable unless all crypto is banned. Banning people to invest money as they wish may be a foreign idea in Western cultures, but not in many authoritative regimes.

172/ Bitcoin might not be the final cryptocurrency. There will be technologically, culturally and monetarily better cryptocurrencies. But the trust and awareness of the Bitcoin brand will be hard to beat near term.

173/ The #DeFi movement will give a boom to novel, never seen before, instruments like interest-bearing cash.

capitalgram.com/posts/interest…

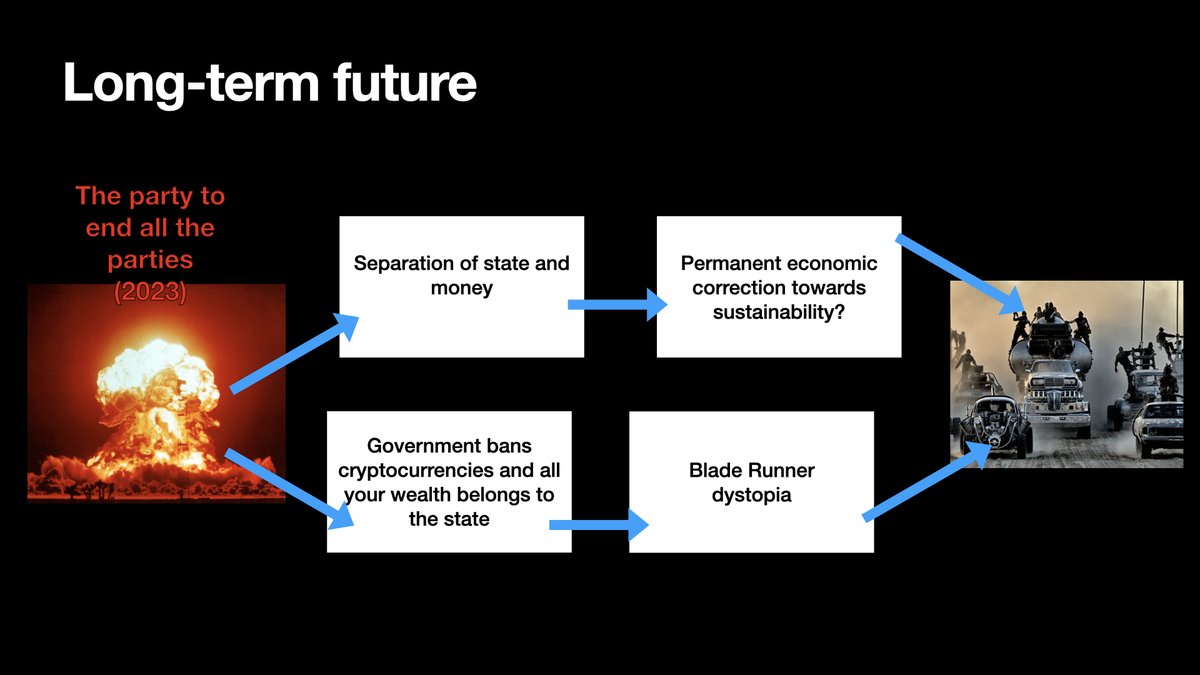

174/ Long term we have few options:

174/ Long term we have few options:Separation of state and money - similar to the separation of state and church in the past.

Young people take away the government's ability to print their own currencies because it will be their self-interest.

175/ Alternative, governments all around the world may become more authoritative just to ensure the interest of people currently in power. This may lead to total ban cryptocurrencies, because no escape hatches can be allowed.

Hello modern slavery.

Hello modern slavery.

176/ We may end up either with Blade Runner like dystopia. Alternative, at some point, there is a correction to sustainability.

However, I do not see the chain of events that would lead the latter to happen.

My investment advice: "Besides #Bitcoin, buy land near freshwater."

However, I do not see the chain of events that would lead the latter to happen.

My investment advice: "Besides #Bitcoin, buy land near freshwater."

Comments

Send any feedback and comments by replying the Twitter thread.

Discuss